What was the financial position as of 31 may 2025?

- Assets At 31 May 2025 we had funds of € 681.8 million. This is more than last month.

- Liabilities The amount of funds we need so that all pensions can be paid (both now and in the future), is € 520.2 million.

- Monthly funding ratio The funding ratio is the ratio between the assets and the liabilities. The funding ratio was 131.1% as at 31 May 2025.

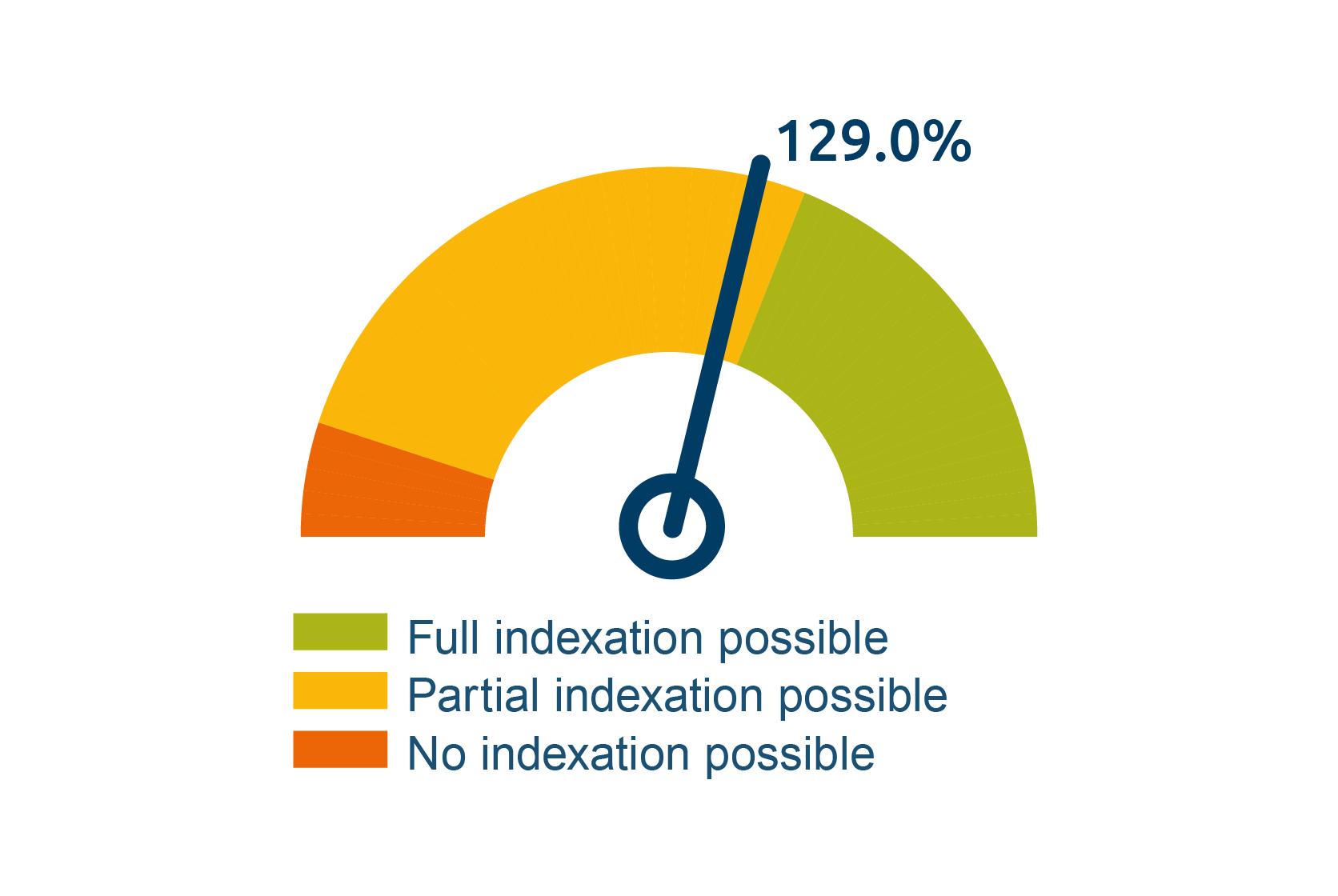

- Policy funding ratio The policy funding ratio is the average funding ratio during the last 12 months. At the end of May 2025 it was 129.0% (average from June 2024 up to and including May 2025).

Accruing compulsory extra buffers

If the assets equal the liabilities, if there is precisely enough money to be able to pay all pensions both now and in the future, then the funding ratio is 100%. That may seem like enough but that’s not the case. Because the future is uncertain, a pension fund has to have buffers. In that way we are able to ensure we can pay everyone a pension even if there are financial setbacks.

Sufficient funds to be able to pay current and future pensions

According to the government rules our assets must amount to 14.3% more than our liabilities. We therefore have to have sufficient funds to be able to pay current and future pensions, plus a hold buffer of 14.3%. That gives us a comfortable cushion in the event of any unexpected reduction in assets. The current policy funding ratio is 129.0%, so we have a buffer of 29.0%.

What are the risks for members in the event of a shortfall situation?

If the funding ratio is too low, it affects the likelihood of increasing your pension (indexation). The Pension Fund may only increase your pension if it is financially healthy and it must also take into account its future financial position. An alternative measure is to reduce the pensions.